By Kristian Jackson and Marc Pratta

Implementing a financial system can be a challenging exercise that is critical to the success of a financial institution. Robotics Process Automation (RPA) technology offers the promise of reducing time and cost from this process and helps improve its quality.

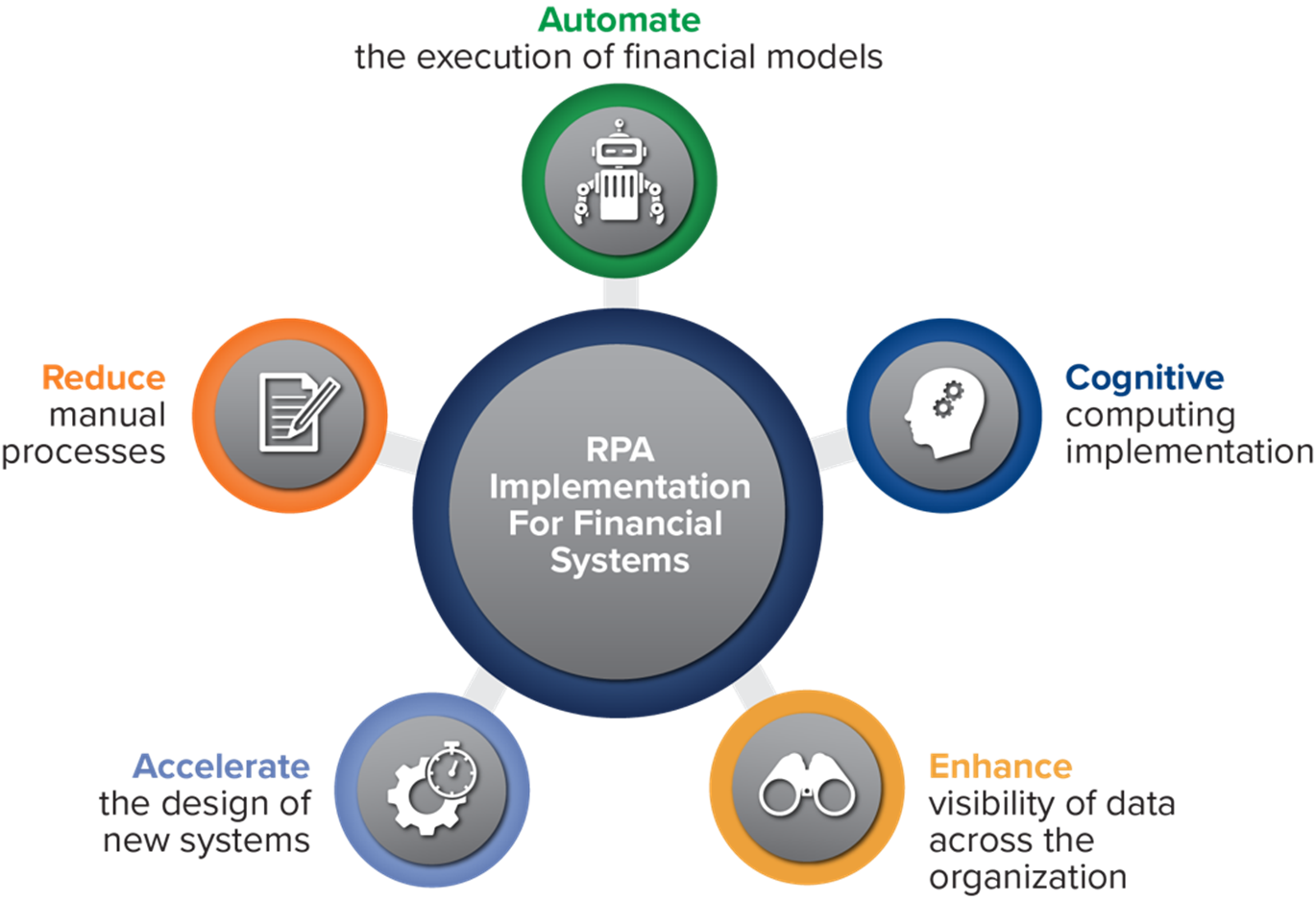

Five ways that RPA can help with the implementation of a new or upgraded financial system include:

1. Automating the execution of financial models

2. Using cognitive computing

3. Enhancing the visibility of data across the organization

4. Accelerating the design of the new system

5. Helping reduce manual processes.

Automating the Execution of Financial Models

Let’s begin with the notion of using automation or technology to its fullest extent. RPA technology, for example, can help streamline the process of designing new systems, testing new functionality, and running financial models. So, what use-case-driven RPA technology can be applied?

Design an Automated Implementation Process

Many implementations, even large-scale ones, still involve manual processes where people are sent between different systems and platforms to conduct various parts of the implementation. In the time between creation and execution of the design, these new implementations can be built for the new system but will not automatically run the application. The new system can be built but may not be fully capable of running the new application. In addition, what if RPA can automate the actual execution of the new system or implementation? If financial RPA technology can be used to automate these processes, and the design is automated, the same can be said for the implementation in the following areas:

Leverage a Predictive RPA

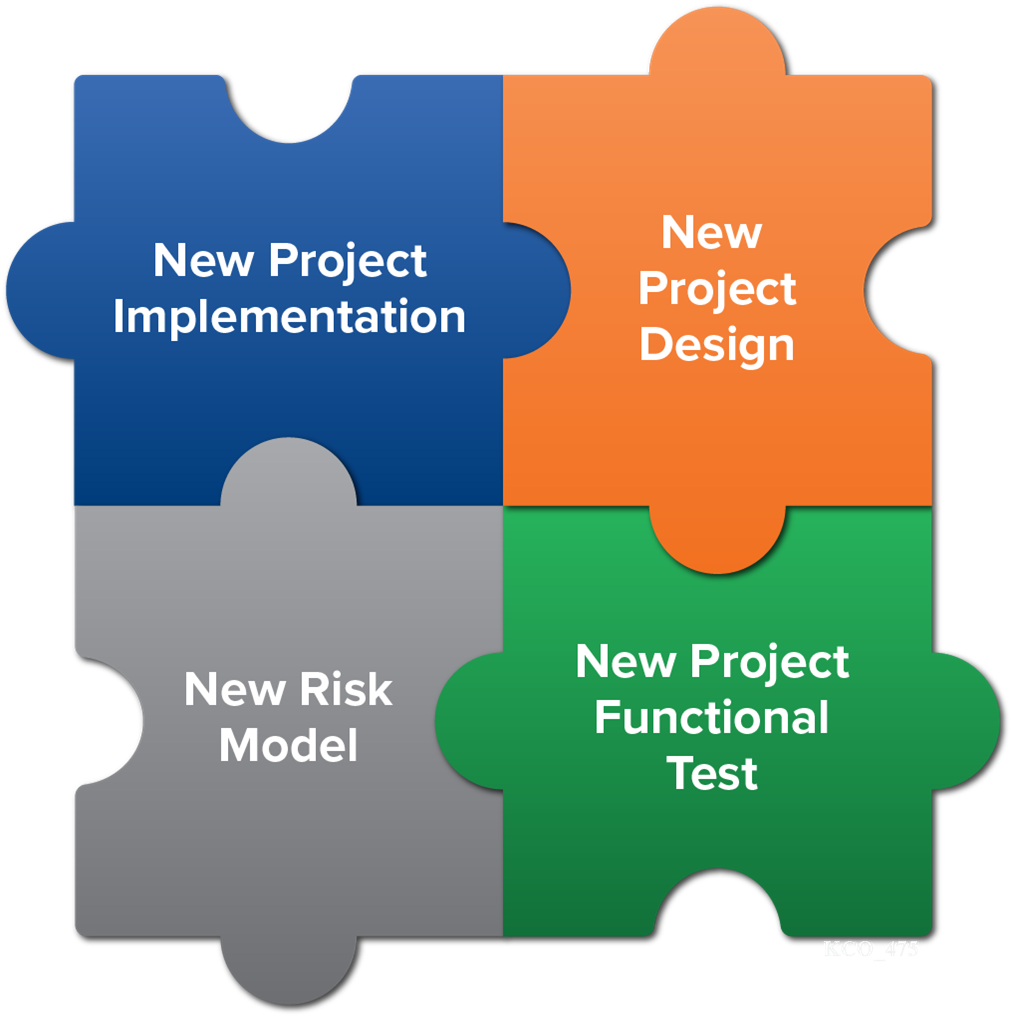

The new project must be created before planning a new project implementation or design. Development of a project plan is the first step; however, there is a need for a series of steps or milestones in this plan that can use RPA to predict when each of the steps should occur, how long that should take, and when each of these tasks should be completed. The plan can then be leveraged to create a schedule that will result in an optimal time to market and cost of deployment. The capabilities of predictive RPA can further be incorporated to predict potential outcomes of new risks created by the project implementation. In addition to predicting outcomes, predictive RPA can also utilize the new project functional test results to evaluate the likelihood of risk events.

Using Cognitive Computing

RPA can also be applied in cognitive computing and automation to create a new financial RPA design. In this sense, RPA represents the first iteration of cognitive computing in the financial industry. Cognitive computing leverages artificial intelligence (AI), the ability for an RPA system to solve a problem based upon a large corpus of accumulated knowledge, to solve financial problems.

RPA technology is evolving in the financial services and asset management industry and is a good example of the emerging cognitive computing market in the financial industry. Financial transactions tend to have strictly defined criteria that result in repetitive processes that were traditionally performed by humans. With RPA, we can now automate the design, execution, and testing of many of the tasks that traditionally required the cognitive capabilities of the human brain.

Enhancing Business Visibility

We can ensure that the new system or implementation is designed in a way that provides the business with more visibility to relevant information and actions by integrating RPA technologies into the traditional system. For example, additional data being received from other systems or platforms, such as external Application Programming Interface (API), which are not typically visible to the business, can be added to enable the business to have a clearer understanding and an improved ability to interpret the new data that is available.

Having access to such data will allow for new opportunities, such as the ability for a new application to look up different data, such as an exchange rate, to better understand the data and perform actions for the business based upon these data. The ability to search information from other systems and platforms is essential. Therefore, in a cognitive computing world, RPA systems, can help businesses to leverage innovative technology to better interpret and understand the data that is coming in.

Accelerate the Design of a New Financial System

RPA can be used to accelerate the design of a new or upgraded financial system and can be used to build the system from the beginning. Creation and design of the new system, development of a deployment strategy, design of the application, and building and deployment (manually or using cloud technology) can all be enhanced through leveraging RPA.

In addition, RPA can help to build the new system in an automated, effective, and efficient way. With RPA, a designer can create an application, test functionality, and test and execute data without the need for manual intervention or direct code edits.

Removing Manual Tasks

Leveraging RPA can also help eliminate or reduce manual tasks. In many instances with RPA technology, the tasks that need to be performed are automated, and many other jobs become much more efficient and effective for business users. For example, let’s take a task that usually involves thousands of lines of code, or hours of maintenance work. Can an RPA system perform that task automatically? Can an RPA system help reduce the time and costs required to complete this task? If the answer is “yes,” then we have a winner-take-all scenario. In addition, if the RPA solution can be leveraged to automate manual tasks, many financial institutions can see a reduction in their overall costs.

With the use of RPA technology, many of the processes that previously required manual intervention are now being automated and can be leveraged to improve the quality of the software and the process used to put the system into operation. RPA technology can be used to help financial institutions to implement or upgrade a new system, as well as design and develop systems that involve new applications as part of a more advanced system and can reduce manual work, reduce build-test-deploy-cost, and time-to-market costs. We discussed some of the ways that RPA technology can be used in the financial industry and that use will change how the financial industry is structure and how work is performed for all financial professionals. Next, we want to focus on what the future holds for you.

This publication is for informational purposes only and does not constitute professional advice or services. Readers should first consult with a professional before acting with regard to the subjects mentioned herein.

Kearney & Company, P.C. (Kearney) is a Certified Public Accounting (CPA) firm that is exclusively focused on providing accounting and consulting services to the Government. For more information on RPA technology and how to leverage RPA solutions, please contact Fola Ojumu ([email protected]).